Prometheus will identify negative momentum in projects that are headed downward or need to be pronounced dead. Each coin is assigned a predictive failure rate based on its current trajectory

Turn Declining Tokens Into Productive Assets

Earn Real Yield, Effortlessly

Move Forward With Soteria Labs

Soteria

When traders get stuck with steep losses, they are left hanging

When traders get stuck with steep losses, they are left hanging Sometimes they need a hand getting back in the game

Sometimes they need a hand getting back in the game Cash out, record the loss, and move on to the next possibility

Cash out, record the loss, and move on to the next possibility

Soteria Protocol

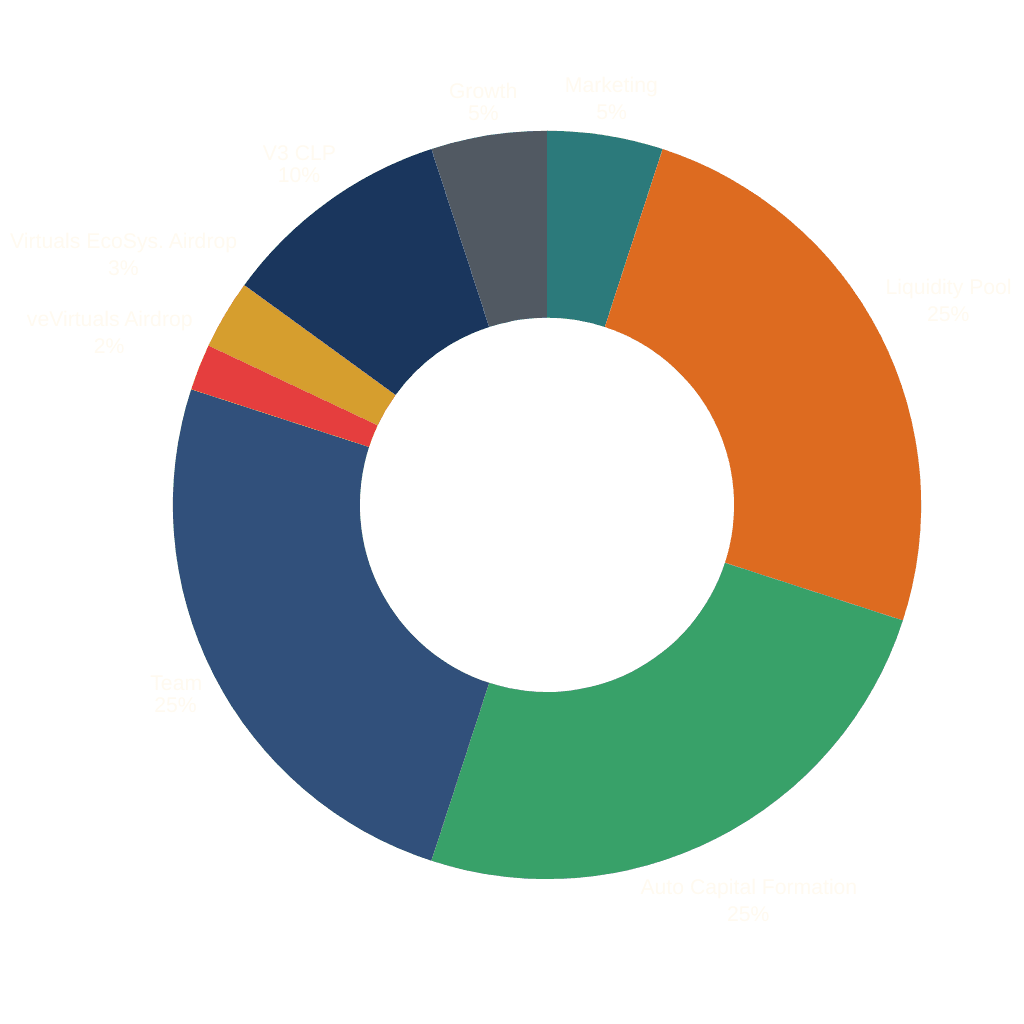

$TERMS

YIELD FARMING

AI AGENTS

Soteria transforms the tokens you'd rather forget into $TERMS, giving them a second life as yield-generating capital.

Depositing $TERMS into the Soteria Vault unlocks automated compounding, rebalancing, and fee generation, your assets work even when you're not watching.

Prometheus analyzes financial and social signals, helping you understand which projects are declining and why, so you can act with confidence instead of guesswork.

When traders get stuck with steep losses, they are left hanging

When traders get stuck with steep losses, they are left hanging Sometimes they need a hand getting back in the game

Sometimes they need a hand getting back in the game Cash out, record the loss, and move on to the next possibility

Cash out, record the loss, and move on to the next possibility